does doordash do quarterly taxes

Ad Follow Our Simple Step-By-Step Process To File Your Rideshare Taxes W Ease Confidence. In the US you are considered self-employed so you are responsible for paying your own taxes.

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

As I write this its 2020.

. If you made more than 600 working for DoorDash in 2020 you have to pay taxes. I personally keep a mile log in notes on my phone. Do you have to pay taxes on Doordash.

IRS will come knocking if you dont know what to do. Each quarter youre expected to pay taxes for that quarters payment period. More importantly a certified tax preparer can also help you identify all of the work-related.

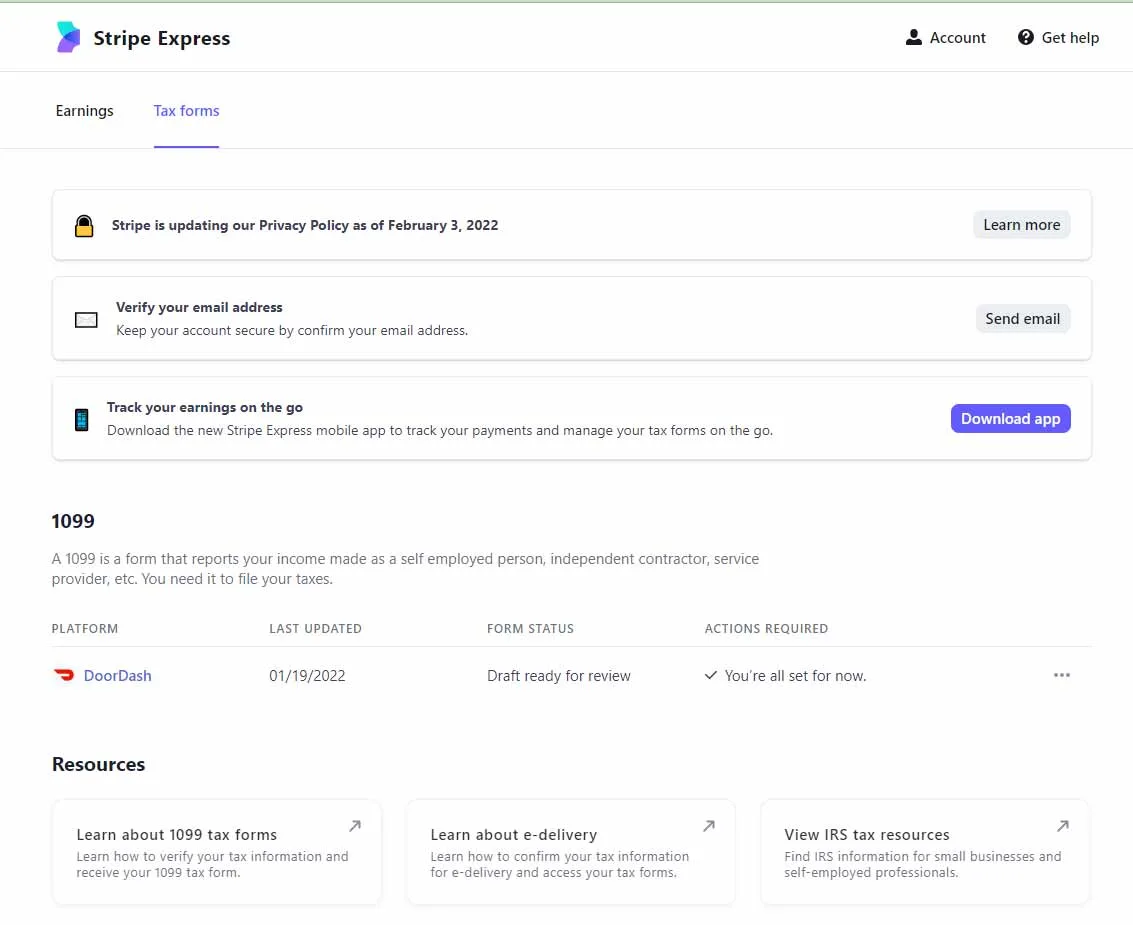

Youll get an email from a company called Stripe. - All tax documents are mailed on or before January 31 to the business address on file with DoorDash. There is no such thing as quarterly taxes.

If Dashing is a small portion of your income you may be able to increase your income tax withholding at your day job instead of paying quarterly taxes. However you still need to report them. DoorDash does not take any taxes.

Each quarter youre expected to pay taxes for that quarters payment. How do Dashers pay taxes. How much do you have to pay in taxes for Doordash.

If earnings were less than 400 in profit they do not. The answer is no. Many DoorDash drivers need to pay quarterly estimated taxes and self-employment taxes.

Its a straight 153 on every dollar you earn. It may take 2-3 weeks for your tax documents to arrive by mail. You also dont have a set tax bill without knowing the amount of expenses you incurred.

These individuals can for a fee help you navigate the appropriate way to file taxes on 1099 earnings to cover your liability. Then I adjust it at end of year to more or less miles as needed. For example 10000 miles is 5800.

As an independent contractor you are. DASH came out with a quarterly loss of 072 per share versus the Zacks Consensus Estimate of. Be aware the due dates arent exactly quarterly.

There is no quarterly tax youll get at 1099 at the beginning of next year. Technically both employees and independent contractors are on the hook for these. For 2021 all employers must withhold 62 for Social Security and 145 for Medicare from employees gross wages.

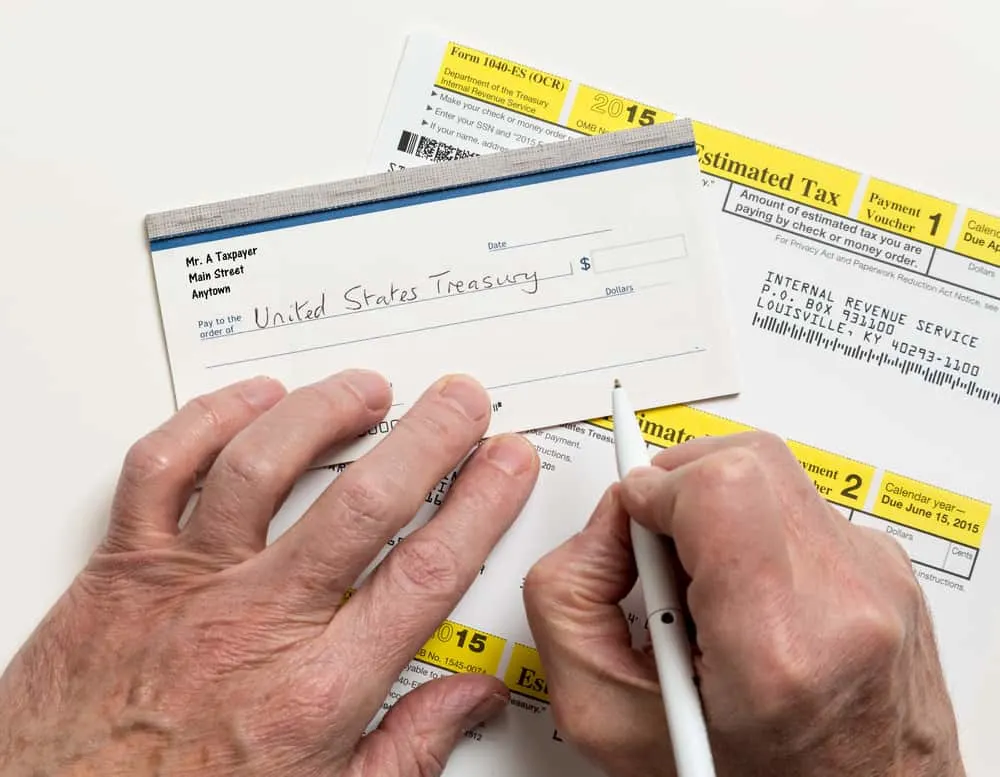

You can also use the IRS website to make the payments electronically. The process of figuring out your DoorDash 1099 taxes can feel overwhelming from expense tracking to knowing when your quarterly taxes are due. Its 153 of your net profit.

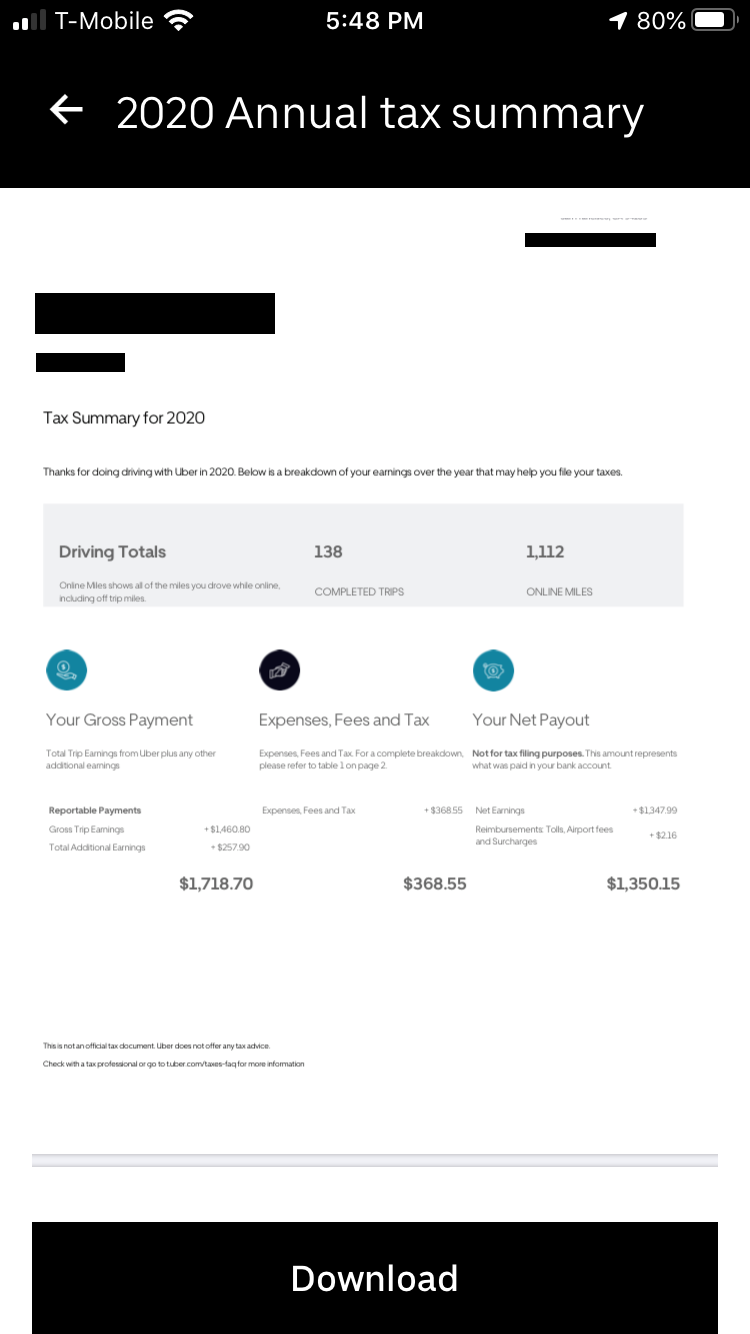

Since youre an independent contractor you might be responsible for estimated quarterly taxesespecially if DoorDash is your sole source of income. Each year tax season kicks off with tax forms that show all the important information from the previous year. Does Doordash take taxes out of my paycheck.

If you dont pay the quarterly estimated taxes you will be fined a small penalty when you file your taxes by April 15th. How To Pay Quarterly Taxes. Incentive payments and driver referral payments.

I mentioned that technically the tax bill is due the next year. How do Dashers pay taxes. How Does Doordash Taxes Work.

Restaurant owners are then required. FICA stands for Federal Income Insurance Contributions Act. Now its May 15 2021.

To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153. The self-employment tax is your Medicare and Social Security tax which totals 1530. DoorDash drivers are not full-time employees of the company which means that DoorDash does not withhold taxes from your income.

Paper Copy through Mail. As such it looks a little different. Youll click a link from stripe and get your 1099.

Unless the government changes things around like they did this year on April 15 next year your taxes for this year are due. However with the freedom of working for yourself also comes responsibilities such as paying quarterly taxes. This way i decide how many miles i went a day if you get my drift.

Last year on 57000 income betweeen DoorDash and postmates I paid 390 in taxes. Quarterly estimate tax payments are due January 15 What are the quarterly taxes for Grubhub Doordash Uber Eats Delivery Drivers. - If you are eligible for e-delivery you will receive an email invitation the subject of the email is Review your.

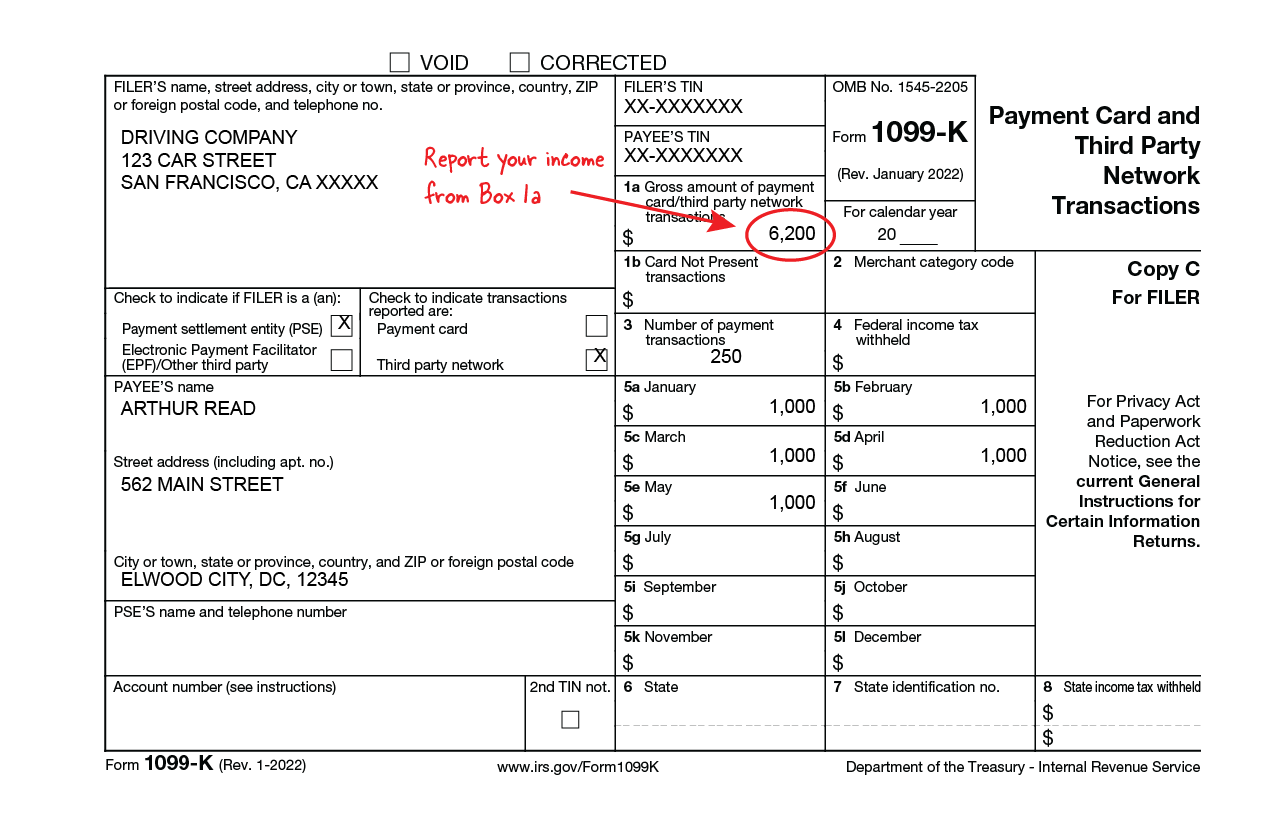

Make sure to pay estimated taxes on time. The Federal Insurance Contributions Act FICA requires a tax on employees wages as well as contributions from employers in order to fund the USs Social Security and Medicare programs. This is the reported income a Dasher will use to file their taxes and what is used to file DoorDash taxes.

If you made 5000 in Q1 you should send in a Q1 payment voucher of 765 5000 x 0153. The first option for properly filing your DoorDash taxes in 2022 is to work with a certified professional tax preparer. Each quarter youre expected to pay taxes for that quarters payment period.

If you dont pay the quarterly estimated taxes you will be fined a small penalty when you file your taxes by April 15th. If Doordash does not withhold taxes for me where does that leave me on tax day. Since youre an independent contractor you might be responsible for estimated quarterly taxes especially if DoorDash is your sole source of income.

TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction. Atention Grubhub Doordash Postmates Uber Eats and other Delivery Drivers who work as Independent Contractors. Do I have to pay quarterly taxes for DoorDash.

Dashers will not have their income withheld by the company to pay for these taxes so youll need to pay them on your own. Do you owe quarterly taxes. It may take 2-3 weeks for your tax documents to arrive by mail.

There are no tax deductions or any of that to make it complicated. If you earn more than 400 as a freelancer you must pay self-employed taxes. Do you owe quarterly taxes.

Dashers should make estimated tax payments each quarter. Youll receive a 1099-NEC if youve earned at least 600 through dashing in the previous year. Your vehicle mileage and vehicle maintenance can all be used as a tax deduction.

Heres a checklist and basic steps to pay quarterly. DoorDash does not take out withholding tax for you. Form 1099-NEC reports income you received directly from DoorDash ex.

Instructions for doing that are available through the IRS using form 1040-ES. The bill though is a lot steeper for independent contractors. From flexible work hours to not reporting to a boss being self-employed comes with a lot of perks.

Then file your taxes. Answer 1 of 4. Here are the due dates for 2021.

Well You estimate the taxes that will be owing on your earnings. Depending how much taxes do you pay for doordash your tax bracket in retirement that could save you 10 to 37 in. Make sure to pay estimated taxes on time.

Do I have to pay DoorDash taxes quarterly. E-delivery through Stripe Express. A 1099 form differs from a W-2 which is the standard form issued to employees.

Yes you will have to pay taxes just like everyone else. If you wait until April to pay you could have to pay a. Gross earnings from DoorDash will be listed on tax form 1099-NEC also just called a 1099 as nonemployee compensation.

Theres a problem with that caption. Since youre an independent contractor you might be responsible for estimated quarterly taxes especially if DoorDash is your sole source of income. Get help with your DoorDash taxes.

Answer 1 of 4. 2 days agoDoordash reports Qtrly Revenue of 16 Billion up 30. Make sure to pay estimated taxes on time.

Do you owe quarterly taxes. Your FICA taxes cover Social Security and Medicare taxes 62 for Social Security and 145 for Medicare.

Paper Receipts For Taxes Tax Myth Business Tax Deductions Credit Card Statement Receipts

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash Taxes Does Doordash Take Out Taxes How They Work

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash Taxes 13 Faqs 1099 S And Income For Dashers

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

Doordash 1099 Critical Doordash Tax Information For 2022

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

The Best Guide To Doordash Driver Taxes In 2021 Everlance

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

How Do Food Delivery Couriers Pay Taxes Get It Back

2021 Daily Income Mileage Toll And Taxes Tracker For Etsy In 2022 Daily Expense Tracker Rideshare Income

The Complete Guide To Doordash 1099 Taxes In Plain English 2022

Doordash 1099 Critical Doordash Tax Information For 2022

How Do I File Doordash Quarterly Taxes Due September 15

Quarterly Tax Payment For Doordash Grubhub Drivers Entrecourier

Doordash 1099 How To Get Your Tax Form And When It S Sent

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt